Happy Birthday, America!

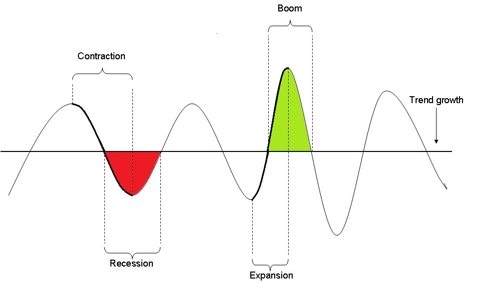

The typical economic cycle consists of two main phases: Boom and Recession. The phase leading to a boom is called expansion and that leading to a recession is called contraction. Another way of looking at this is considering expansion the transition from recession-boom and contraction the transition from boom-recession.

click to enlarge

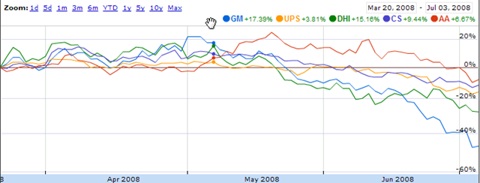

10 signs that an economy’s in recession:

- Automobile companies are down (GM)

- Package Carriers are hurt (UPS)

- Real Estate companies are down (DHI)

- Financial Sector is down (CS)

- Aluminum and Steel companies are down (AA)

The trending in the first 5 sectors looks bleak. Are we really doomed?

Remember I said there are 10 signs. Let’s look at the next 5 signs and then discuss the recession for real:

- The airlines industry is trending down (DAL)

- Retailers such as Sears are down (SHLD)

- Farm equipment manufacturers are down (CAT)

- Mid-sized hotels are down (CHH)

- Industrial real-estate developers are down (FWLT)

Looking at the chart above, it’s obvious that FWLT and CAT are trending down but are the only ones not in the red yet. This is semi-good news. There’s still some expansion going on in industrials and agriculture – this indicates that we are in the contraction mode of the cycle and are currently looking at imminent recession. However, I’m hoping that corrective measures are taken before this situation actually spirals out of control. What corrective measures, you may ask?

First and foremost, there should be an increase in the short term interest rates. This will help in 3 immediate ways:

- Higher interest rates strengthen the dollar by making it a lucrative investment for all. If the dollar has to be competitive with the Euro, this increase has to happen soon as the Euro banks hiked their interest rates this past week. A stronger dollar gets more bang for the buck and brings back a semblance of balance in the currently insanely skewed US trade deficit.

- It separates the wheat from the chaff. People who don’t deserve loans don’t get one as they can no longer afford to—the biggest problem with low interest rates is that it creates a low barrier to entry which forces business to compete for diminishing margins and mandates quantity versus quality of loanees. Therefore, our subprime crisis of today.

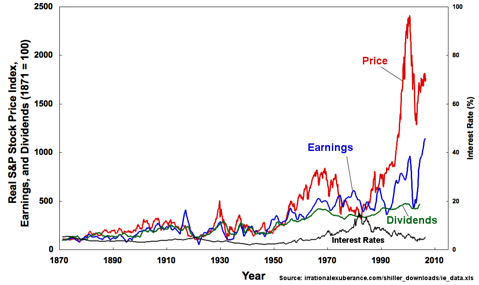

- It helps drives inflation down. In the early 1980s when inflation was severely high, the Fed tackled it by increasing interest rates. Rates were as high as 18% then versus the paltry 2.5% they are today.

I believe the Fed would have increased interest rates already had they not been pulled into salvaging and saving the banks caught in the quagmire of the subprime crisis.

The chart below shows whenever the economy’s been in a recession historically (see 1980 or 2000), an increase in interest rates has had an ameliorating and rejuvenating effect on the market. The Y2K downturn was converted into an upswing in 2003 through the increase in interest rates. It’s time we saw an increase in both interest rates and the market versus inflation, for a change.

Today’s economies are global and the US has a lot of things to go manage at the same time (fix the $, inflation, deficits, energy demands etc.). Just increasing the interest rates may not be the silver bullet anymore. It’ll require a series of steps besides that, such as the bursting of the energy bubble.

What do you think?

Nenhum comentário:

Postar um comentário