Global markets

Bearish battalions

Jul 3rd 2008

From The Economist print edition

Almost everything that could is going wrong for world stockmarkets

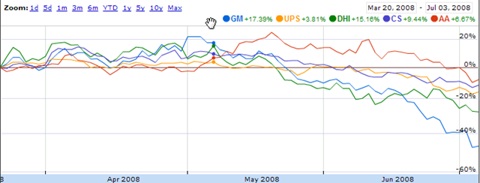

THEY rarely ring a bell at the bottom of bear markets. Investors who thought they had heard a tinkling sound when Bear Stearns, a failing American investment bank, was bundled into JPMorgan Chase in March have been disappointed. The Dow Jones Industrial Average is now weaker than it was in the spring (see chart).

The American stockmarket had its worst month since 2002 in June and is now down more than 20% from its peak, the definition of a bear market. It is not alone. According to Standard & Poor’s, a rating agency, the value of global stockmarkets fell by $3 trillion during the month, thanks in particular to a 10% decline in emerging markets.

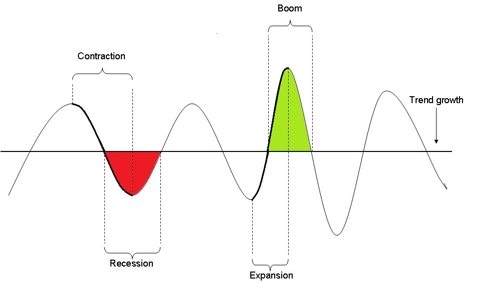

Share prices are suffering because of the outlook for four forces that impel stockmarkets: economic growth, profits growth, interest rates and inflation (see article). At the moment, the first two seem to be slowing while the last two are rising. That is the worst possible combination.

Soaring oil and food prices are stoking inflation. Oil closed at another peak of $144.14 a barrel on July 2nd, because of disappointing data on American crude reserves, and lingering fears that sabre-rattling between Israel and Iran might lead to conflict in the Persian Gulf. High commodity prices have also acted as a terms-of-trade shock for consuming countries—the things they buy from abroad cost more compared with the things they export. That has made them poorer.

The past six months could be seen as a dreary exercise in sharing out the pain. Will workers suffer by seeing their wages rise more slowly than inflation? Will companies have to compensate their workers by raising wages, sacrificing their profit margins? Will central banks treat high commodity prices as a blip, and leave real interest rates low, penalising savers? Or will they raise interest rates and risk pushing the economy into recession? None of these choices is palatable.

All this has been made worse by the credit crunch. True, the rescue of Bear Stearns seemed to avert the implosion of the financial system. Credit spreads, which measure the excess interest rate paid by riskier borrowers, have fallen from their March peaks, although they have recently been rising again.However, the crunch continues to chew its way through the system. Its effects can be seen in the sharp falls in mortgage approvals in both America and Britain. And it can also be seen in data produced by the Federal Reserve which show that loans made by banks (their assets, in the jargon) have fallen over the past three months.

This tightening in credit has taken so long to show up in the numbers because of the way that banks were operating before the summer of 2007. First, they had pushed much of their lending business off-balance-sheet, so that loans were bought by specialist entities like structured-investment vehicles (SIVs) and conduits. When the market for subprime loans collapsed, a lot of these loans came back on to the banks’ balance-sheets. Second, banks had made back-up commitments to businesses to lend money if needed. With the collapse in other debt markets (such as asset-backed commercial paper), corporate borrowers cashed in those chips. Much as they would have wished otherwise, banks found their loan books expanding.

Now, chastened by the huge amounts of capital they have had to raise to strengthen their balance-sheets, banks are being more careful. According to Ian Harnett of Absolute Strategy Research, a consultancy, the availability of credit in Europe for both consumers and companies is now at its lowest level since 2003.

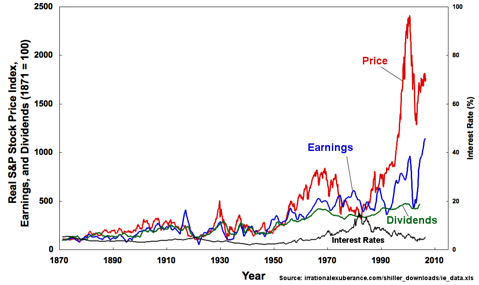

The problem for financial markets is that the virtuous circle which pushed asset prices higher in the middle of this decade may be turning vicious. Banks lend money against the collateral of assets, most notably in the form of housing. As house prices increase, the collateral rises in value and the banks are willing to lend more. That enables buyers to bid up prices even further.

But when banks stop lending, buyers are unable to purchase assets. Some investors are forced to sell to pay off loans. The value of collateral falls, making banks even more reluctant to lend. Markets freeze up, as neither buyers nor sellers have the confidence to do business.

As house prices fall in America, Britain, Ireland and Spain, the wealth effect kicks in. George Magnus, a strategist at UBS, cites the examples of Finland and Sweden in the early 1990s. As house prices fell, personal-savings rates jumped by 12-14 percentage points. A similar move in America or Britain would have a devastating effect on consumer demand, and thus on GDP growth over the next couple of years. As yet, there has been more of an effect on consumer sentiment than actual retail sales, although individual retailers (such as Britain’s Marks & Spencer) are suffering.

As for companies, with consumers depressed and banks unwilling to lend, why should they invest? They may still see exports as a source of economic growth, but that works only for some firms in individual countries, not for those in the world as a whole.

So the market’s sorrows have come in battalions, not single spies. Investors might have coped with the credit crunch if it were not for the high commodity prices, and vice versa. They do not know whether to fear inflation or recession more, but they know that both at once will be unpleasant.

It looks like a lengthy period of gloom is in store for the stockmarkets. Meanwhile, the best investors can do is hope, Micawber-like, that something will turn up. A collapse in oil prices would help.