The Daily Reckoning Week in Review

Melbourne, Australia

November 16th to November 20th, 2009

By Dr. Alex Cowie

|

US Dollar index (the last ten years)

A few weeks back we discussed the possibility of US dollar rally. With good reason. The chorus of the majority is singing the decline of the dollar in full voice. When everyone in the markets is in agreement, everyone is usually wrong.

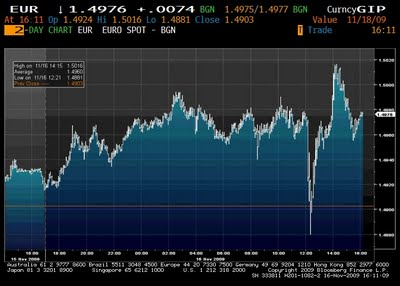

However there is no sign of the dollar rallying just yet. In fact if you look at the dollar index above (black line), you can see that the US dollar would have to have a considerable rally to get back to where it was at the start of the year.

The red line shows the two hundred week moving average demonstrating the long-term trend. The blue line shows the fifty week moving average which demonstrates the short-term trend. Just like in Ghost-Busters, when the streams cross, it's generally bad news.

It signals a fundamental change. The first intersection in 2003 signalled the start of another five years of downtrend. The next time lines crossed a few months ago signalled the end of the dollar's mini-rally. Now the lines are crossing again, suggesting the dollar is in for another dose of freefall.

The enigmatic

Marc Faber is known for his frequently correct predictions of major market events, such as the 1987 crash. He has been making his bearish views on the US dollar clear for some time. He startled Bloomberg viewers a few months ago when he said, "I don't think the US Dollar will be replaced right away as the reserve currency or as the world's most important currency. But I think the importance of the US dollar will diminish, and over time the

US Dollar will become worthless. That is a fairly high confidence prediction that I have."

He went on to say, "McDonald's has a better credit rating than the US government. The US government is essentially cash flow negative."

He's not the only one who has his concerns about the falling dollar. This week, Liu Mingkang, the chairman of the China Banking Regulatory Commission had a go whilst U.S. President Barack Obama was in town. He is also justifiably critical of the protracted loose US monetary policy, and the global bubble it is creating.

He said, "The continuous depreciation in the dollar, and the US government's indication that, in order to resume growth and maintain public confidence, it basically won't raise interest rates for the coming 12 to 18 months, has led to massive dollar arbitrage speculation."

China has to take some blame as well. China denied that the Yuan was manipulated when U.S. Treasury Secretary Timothy Geithner made accusations in the past. Dominic Strauss Kahn, the Managing Director of the International Monetary fund believes that the currency is still fundamentally undervalued.

This gives China an unfair trade advantage. Chinese exports are kept artificially cheap relative to other exporters. Exports are nearly 40% of China's GDP, and the reason why it is sitting on over $2 trillion of foreign exchange reserves.

Not only is the Yuan kept artificially cheap, but

it is pegged to the US dollar. So as the dollar goes down, the Yuan goes down too. For all of his diplomacy, President Obama doesn't seem to have changed China's mind about its policies or even to co-operate for the financial good of the rest of the world (assuming it's in the world's interests to see a stronger Yuan).

The response from China has been lukewarm. But why shouldn't it be? The US is hardly in a moral position to be able to lecture on financial management.

With nothing resolved, we can expect the Dollar-Yuan's destructive and co-dependent marriage to drag on. The dollar will keep heading south, and the Yuan will keep trailing it lower. Bubbles will keep growing, and gold will keep glowing.