Segue-se uma crise de crédito. Logo o temor se espalha por Wall Street, onde os grandes bancos repelem rumores de insolvência em meio a um pânico econômico geral. Washington é forçado a interferir. O mercado desfalece.

Se isso soa familiar, deveria. Salvo que não estamos falando da crise dos empréstimos hipotecários subprime (de alto risco), ou dos acordos intermediados pelo Departamento do Tesouro na semana passada com três gigantes do setor bancário americano, para fornecer US$75 bilhões a um fundo com vistas a estabilizar o mercado de crédito global, ou a queda de 366 pontos da sexta-feira retrasada no mercado acionário.

De fato, essa é uma breve história do Pânico de 1907, que culminou exatamente há 100 anos, no dia 21 de outubro.

Na época, os prejuízos provocados pelo terremoto em San Francisco um ano antes afetaram fortemente as seguradoras britânicas e finalmente forçaram as autoridades do governo dos Estados Unidos, e o próprio JP Morgan a irem em socorro. Na noite de 21 de outubro de 1907, o legendário magnata convocou os mais importantes financistas à sua mansão em Manhattan, para ajudarem a financiar o pacote de ajuda.

"Aqui terminam os problemas", foi a famosa declaração de Morgan. Ele teve êxito. No início de 1908, o pânico tinha passado. Hoje é o JP Morgan, a empresa e não o homem, juntamente com Citigroup e Bank of America, que tentam solucionar os problemas, impulsionados pelo secretário do Tesouro, Henry Paulson, que, como ex-chefe da Goldman Sachs, é uma espécie de magnata contemporâneo.

O aperto de crédito deveria estar no topo da agenda dos países desenvolvidos. Desta vez, contudo, pode levar muito mais tempo para reparar os danos e restaurar a confiança, como aconteceu há um século. Não é só o fato de as somas hoje serem maiores: mesmo ajustando um século de inflação, os prejuízos provocados pelo terremoto de San Francisco totalizaram apenas US$ 18 bilhões em dólares atuais, de acordo com Marc Weidenmier, professor de economia no Claremont McKenna College, comparados com a provável perda de centenas de bilhões de dólares relacionadas aos empréstimos hipotecários subprime.

Ocorre também que a amplitude e a complexidade dos mercados globais de hoje criam riscos tão grandes que nenhum grupo de líderes empresariais - ou mesmo um único país - pode controlá-los.

Quanto aos valores dos títulos lastreados por hipotecas que estão no coração dessa desintegração dos créditos subprime, um especialista como Benjamin S. Bernanke, presidente do Federal Reserve (Fed, o banco central americano), admite que não sabe. "Gostaria de saber o quanto valem", disse Bernanke na sessão de perguntas e respostas depois de um discurso pronunciado em Nova York, duas semanas atrás.

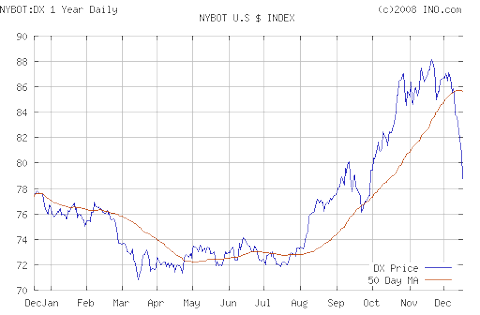

É o caso de muitos proprietários de imóveis, que normalmente não se preocupam com as atividades internas do Fed. Ao contrário do pânico passado, ou mesmo do desastre financeiro de 1987, esse atual tumulto no setor creditício afetou consumidores comuns que querem apenas garantir uma hipoteca ou refinanciar um empréstimo. As taxas subiram até para tomadores de empréstimos melhor qualificados.

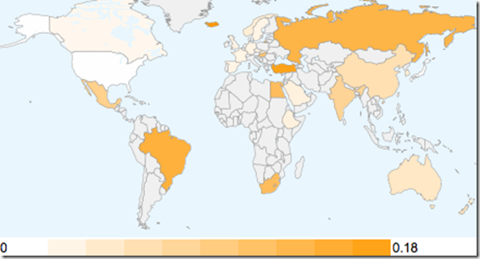

Esse fenômeno atinge ambos os lados. Não só aquelas pessoas que não têm um centavo em ações são afetadas pelas oscilações, mas, numa era em que a inadimplência no setor hipotecário nos Estados Unidos pode mexer com os mercados de Londres a Mumbai e Xangai, parece que decisões incorretas adotadas por um emprestador em Cleveland ou um tomador de empréstimo em Miami, podem ter implicações mundiais.

Numa viagem na semana retrasada à Nova Zelândia, para reunir-se com investidores, Byron R. Wien, chefe do setor de estratégias de investimento na Pequot Capital, e um veterano de 40 anos de Wall Street, observou que, "em todos os lugares que percorro, as pessoas me perguntam sobre o problema do subprime e sobre mudança climática; essas são as duas grandes questões".

As coisas não deviam funcionar dessa maneira. Os mercados globais interconectados deviam tornar o mundo econômico mais estável, segundo a teoria econômica tradicional, com o risco se difundindo mais amplamente e a solidez de uma região compensando as fragilidades em outra.

"Na prática, não estamos vendo isso acontecer", disse Richard Bookstaber, experiente administrador de fundos hedge e autor de um novo livro A Demon of Our Own Design: Markets, Hedge Funds and the Perils of Financial Innovation (numa tradução livre, Um demônio projetado por nós: mercados, fundos hedge e os perigos da inovação financeira).

Embora os elos financeiros internacionais não sejam nada novos, como mostra o Pânico de 1907, hoje o que é diferente é o fato de os mercados internacionais estarem muito correlacionados uns com os outros. "Todo mundo tende a investir nos mesmos ativos e empregar as mesmas estratégias", disse o analista, observando que, do mesmo modo que o Citigroup e o Merrill Lynch sofreram bilhões de perdas com os empréstimos subprime, também na França, Alemanha e Grã-Bretanha, bancos foram afetados.

De fato, o banco britânico Northern Rock foi atingido por uma corrida dos depositantes, em setembro, antes de o Banco da Inglaterra intervir eficazmente, e socorrer financeiramente a instituição.

A tendência se estende para as bolsas de valores na Ásia, onde as ações na Índia e China vêm experimentando uma alta parabólica. "Você tem dinheiro americano especulativo investido na Índia, da mesma maneira que tem dinheiro indiano especulativo investido na Índia", ele diz. "Como os mercados ficaram mais ligados, a diversificação não funciona também."

Como resultado, disse Bookstaber, os mercados financeiros globais hoje podem ser na verdade mais arriscados do que no passado. Isso porque os mesmos tipos de investidores estão fazendo apostas arriscadas e depois procuram, simultaneamente, a saída quando o problema aparece, mesmo estando em lados opostos do mundo.

"Se eles se orientam mais para o investimento especulativo, no momento em que você tem um problema, eles procuram se livrar dos seu títulos, por meio de ?dump?, vendendo a preço mais baixo, porque têm muita alavancagem", diz ele.

Historicamente, acrescentou, existem duas características que precipitaram a crise financeira: complexidade e alavancagem. E a atual desordem no segmento subprime, em que hipotecas de alto risco foram negociadas por Wall Street e depois vendidas a investidores que se endividaram muito para comprá-las e que podem não ter compreendido exatamente o que estavam comprando, enquadra-se bem nesse padrão.

Isso tem também implicações para os consumidores comuns, como também para os mestres do universo. Os proprietários de imóveis residenciais com problemas relacionados ao pagamento da sua hipoteca não podem mais renegociar sua dívida com o banco porque sua hipoteca está na posse de um investidor milhares de quilômetros distante.

Ao mesmo tempo, os estrangeiros parecem estar imitando o apetite americano pela assunção de risco e a especulação, mas não estão tendo consciência dos seus perigos.

"Ainda somos grandes dissipadores, mas há evidências de que isso começa a mudar", disse Weidenmier, citando a China como exemplo. Não só os gastos de consumo estão aumentando rapidamente, como os investidores locais têm apostado cada vez mais alto nas ações da Bolsa de Valores de Xangai, com uma valorização de 432% nos últimos dois anos.

Agora, como os problemas nos EUA afetaram, num efeito cascata, a Europa, teme-se que um estouro da bolha asiática possa ser sentido em Nova York. Uma liquidação de posições em Xangai provocou uma queda de 400 pontos no Índice Dow Jones em fevereiro.

Naturalmente, assumir riscos, mesmo especulativos, sempre foi a força propulsora por trás do crescimento econômico e o dinamismo do sistema capitalista. John Maynard Keynes chamou esses impulsos de "espírito animal" e especialistas como Wien discordam da noção de que a globalização tornou as coisas mais arriscadas.

Segundo ele, os novos-ricos em lugares como o Oriente Médio podem, na verdade, facilitar as coisas, por terem dinheiro para comprar quando todo os demais estão vendendo. Essa é uma razão pela qual sua próxima parada depois da Nova Zelândia foi Dubai.

Independente de quem está certo, Weidenmier diz que as crises financeiras acabam fortalecendo o sistema todo. Com efeito, o Pânico de 1907 levou à criação do Federal Reserve, que, desde então, estabelece a política monetária dos Estados Unidos. "Na realidade, às vezes as crises financeiras são positivas", disse ele "porque elas limpam o sistema".

LiveDrive, not to be confused with Windows Live Skydrive, is a free and unlimited online storage service.

LiveDrive, not to be confused with Windows Live Skydrive, is a free and unlimited online storage service.

Given the number of people who use Google Reader’s “Starred items” and “Shared items” features, you’d think Google would have some very good data for creating a killer “best of” area for stories across the web. In the past, people have talked about how such a feature could be a “

Given the number of people who use Google Reader’s “Starred items” and “Shared items” features, you’d think Google would have some very good data for creating a killer “best of” area for stories across the web. In the past, people have talked about how such a feature could be a “ Hickey and Walters (

Hickey and Walters (