Hale "Bonddad" Stewart: It Was a Good Week in Economic News

from The Full Feed from HuffingtonPost.com by

This week we saw more evidence that the worst of the recession is behind us.

ISM Manufacturing

The march to 50 is almost complete. July's ISM manufacturing index jumped a very big 4.1 points to 48.9, pointing to a 50 reading for the August report which would mark no-change from July and the bottom of the manufacturing recession. Strength is all over the place in July: new orders 55.3 vs. July's 49.2, production 57.9 vs. 52.5, backlogs 50.0 vs. 47.5, employment 45.6 vs. 40.7. Inventories also added to the headline index, at 33.5 for a 2.7 point improvement from June. Inventories are very likely to continue to rise in the coming months, indicated not only by the gain in new orders but also by customer inventories which continue to fall, down a point to 42.5 and indicating that firms believe inventories at their customers are too low. Prices paid also rose, up 5 points to 55.0 to hint at the beginning of pricing power.

The main point with this data is the 7 months of increases we've seen:

That shows that the manufacturing sector is clearly moving in the right direction.

ISM Non-manufacturing

In July, the NMI registered 46.4 percent, indicating contraction in the non-manufacturing sector at a faster rate compared to June's reading of 47 percent. A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting.

While the index dropped, the drop was small -- .6 on their scale. In addition, as the chart indicates the overall trend is still positive:

Pending Home Sales

Boosted by low interest rates and bargain home prices, pending sales of existing homes rose in June for the fifth straight month, the longest streak of gains since 2003, a real estate trade group reported Tuesday.

The pending home sales index rose 3.6% in June after an upwardly revised gain of 0.8% in May, the National Association of Realtors said. The overall index is 6.7% above June 2008's level......

Pending homes sales in June rose in all regions: up 7.1% in the South, 2.9% in the West, 0.8% in the Midwest and 0.4% in the Northeast.

This number will probably drop over the next few months as the spring is usually when people move. However, five months of increases is a good sign. Recently, I argued that we've seen a bottom in housing sales. This adds further evidence to that theory.

Employment

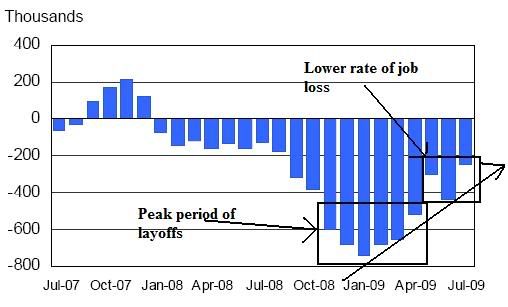

Nonfarm payroll employment continued to decline in July (-247,000), and the unemployment rate was little changed at 9.4 percent, the U.S. Bureau of Labor Statistics reported today. The average monthly job loss for May through July (-331,000) was about half the average decline for November through April (-645,000). In July, job losses continued in many of the major industry sectors.

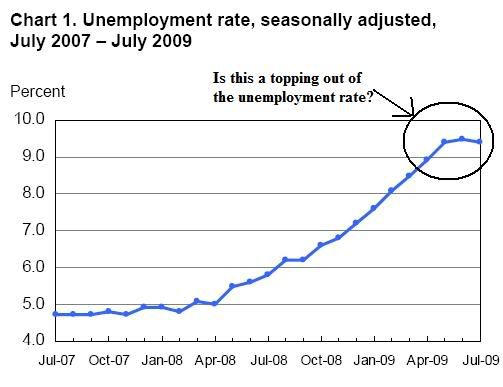

In looking at the report, first note the unemployment rate has been steady now for three months:

In an of itself, that is an encouraging; it indicates there is a possibility the unemployment rate is topping. Adding further evidence the that theory is the general trend of overall job losses:

Note there are two areas. The first shows that maximum job losses occurred in the fourth quarter of last year and the first quarter of this year. However the trend since the beginning of this year is for a continuing decline in the number of job losses per month. As the chart above shows that trend has now been in place for six months, indicating we have a firm trend in place.

But there are other reasons indicating things are improving:

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in July at 8.8 million. The number of such workers rose sharply in the fall and winter but has been little changed for 4 consecutive months.

This is good news as it indicates the level of people who are forced to work part time not because they want to but because they have to has been level for the last 4 months.

Let's combine this information with the initial unemployment claims information from yesterday:

Note that the four week moving average of initial claims continues to move lower. Also note that according to theDepartment of Labor the unadjusted (non-seasonally adjusted) numbers fell by 48,000 last week. This is on top of a loss of 90,000 two weeks age and 60,00 next week. In short -- the unadjusted number of initial unemployment claims has dropped by over 200,000 in the last three weeks.

Personal Income

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI) decreased $143.8 billion, or 1.3 percent, in June, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $41.4 billion, or 0.4 percent. In May, personal income increased $155.1 billion, or 1.3 percent, DPI increased $168.7 billion, or 1.6percent, and PCE increased $9.0 billion, or 0.1 percent, based on revised estimates.

This release presents revised estimates of personal income and its disposition that reflect the comprehensive revision of the national income and product accounts released on July 31. Tables containing historical data will be posted when they become available on BEA's Web site. For more information on the revision, see the text and box on pages 5 and 6. Real disposable income decreased 1.8 percent in June, in contrast to an increase of 1.5 percent in May. Real PCE decreased 0.1 percent, in contrast to an increase of less than 0.1 percent.

As the report indicates, the drop was largely caused by a decrease if government transfer payments. Here is the chart:

There were increases the last two months followed by a drop this month. However, the increases were caused by transfer payments, not increases in wages. It's important to remember that we're not going to see wage increases for a bit, largely because we're in the middle of high unemployment. During a slack labor market, wages stagnate. However, at least the year over year personal consumption expenditures are still moving sideways:

On balance, that's about the best we can hope for with that statistic for now.

Simply put, the evidence is mounting that the economy is moving in the right direction. We've seen 7 consecutive months of increases in the ISM Manufacturing index. The services index is still in an uptrend. Pending housing sales have increased for the last 5 months and the pace of sales has stabilized at low levels. The employment statistics are moving in the right direction.

Bottom line: the evidence that the worse is behind us continues to mount.

Nenhum comentário:

Postar um comentário