Commentary: The markets attempted to stabilize this week after a two-week pullback, closing higher every day of the week. While the bulls displayed some resiliency by bouncing higher, many of the major indexes remain in a precarious position. Technically speaking, most of the indexes are right in the middle of a two-month trading range.

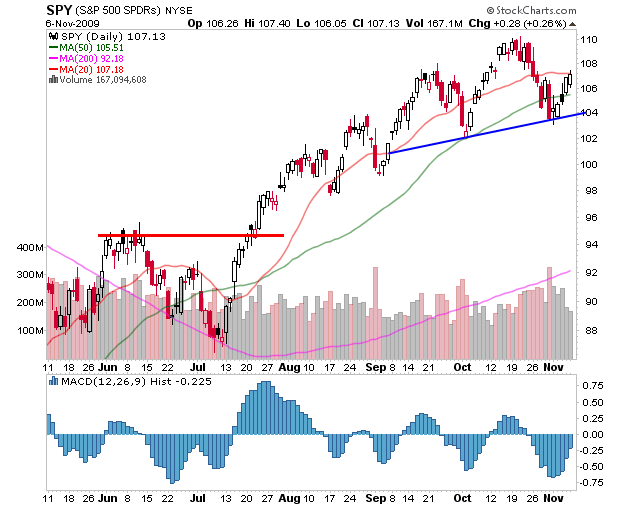

The chart for the S&P500 as represented by the S&P 500 SPDRS (NYSE:SPY) ETF for instance, is trading near the same level where it peaked in early September. There are valid arguments for both bulls and bears alike. Bulls can point out how SPY set a higher low, and remains above a rising 50-day moving average. Bears can point to a possiblehead and shoulders topping pattern developing, and negative divergences in several indicators including the MACD histogram. Two critical areas to watch here are the October highs near $110 and the head and shoulders neckline developing near the $104 area.

|

| Source: StockCharts.com |

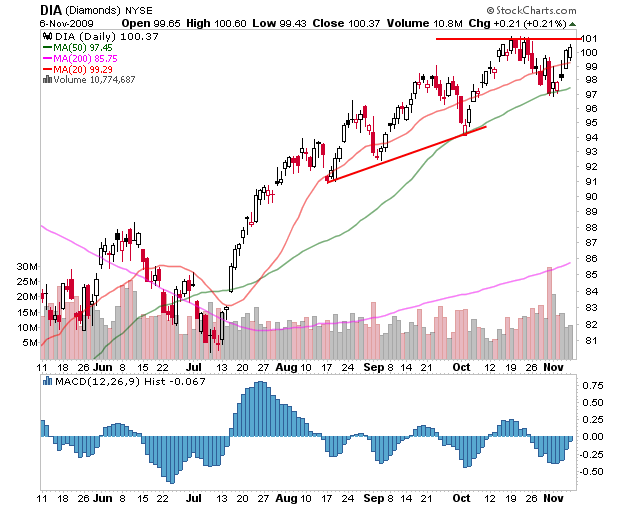

The Diamonds Trust, Series 1 (NYSE:DIA) ETF held up the best of the indexes during the recent pullback as it respected the 50-day moving average as support. DIA continues to make higher highs and is very close to its October high already, although there are still some negative aspects on the chart as well. Volume was very lackluster on this weeks rally, and DIA is also sporting a negative divergence in the MACD Histogram indicator. While divergences should not be used as stand-alone trading signals, they do provide clues that momentum is waning. (For more on this subject, see What does it mean to use technical divergence in trading?)

|

| Source: StockCharts.com |

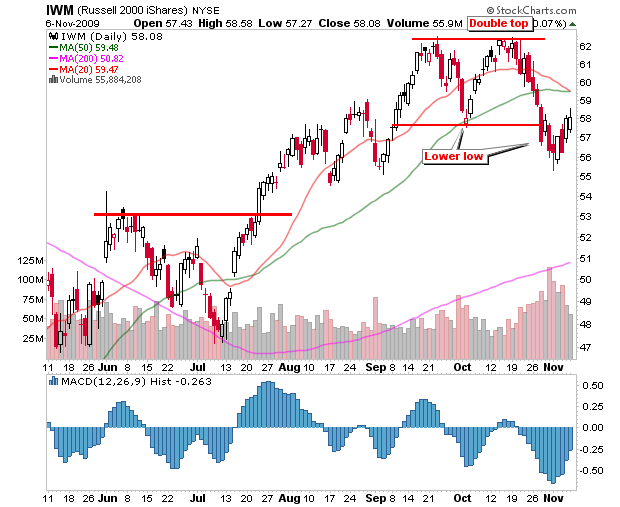

Despite the week's strength, the iShares Russell 2000 Index (NYSE:IWM) ETF continues to look very unhealthy. IWM set a lower low last week, and couldn't muster enough strength to reclaim its 50-day moving average. At this point, the 50-day moving average is starting to roll over and the 20-day moving average is starting to cross below it, which is a clear indication of increasing downside momentum. This moving average cluster near $59.50 could provide stiff resistance if tested next week, and remains a key area to watch.

|

| Source: StockCharts.com |

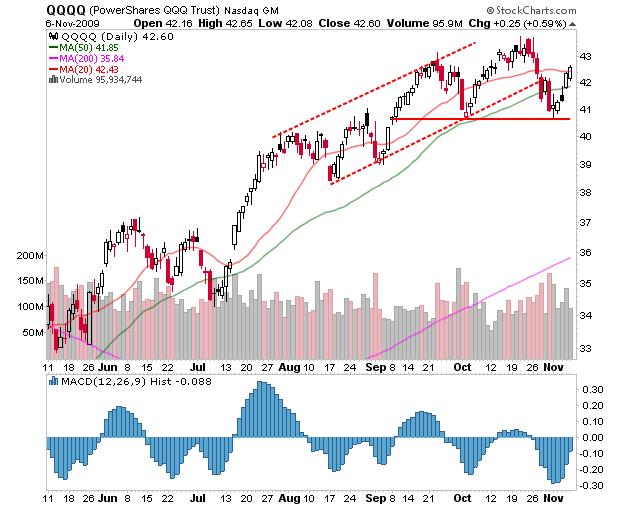

The Powershares QQQ ETF (Nasdaq:QQQQ) is another index-tracking ETF that could be in the process of developing a head and shoulders top. The neckline near $40.60 is a critical level to watch in case there is extended weakness in the coming week. However, QQQQ is also back above a rising 50-day moving average and it never set a lower low, keeping the uptrend in tact. QQQQ, much like the other indexes, remains in the middle of the recent trading range with strong support and resistance levels surrounding it. This ETF could go in either direction right now, and next week should offer a little more clarity.

|

| Source: StockCharts.com |

Bottom Line

The action this week still leaves many questions up in the air, and with both sides having valuable arguments, it could be a time to stand aside. The small caps are pointing lower, while the large caps are holding up. To compound the issue, most of the indexes are also in the middle of their trading range, with no clear low-risk entries to either side. Despite many arguments from both sides, the markets remain vulnerable to a sharp move to either side, and pressing your bets in this environment is a risky proposition to say the least. Often as a trader, one of the most important traits is learning when to tone it down and step aside until better risk versus reward opportunities arise. This may be one of those times. Use the Investopedia Stock Simulator to trade the stocks mentioned in this stock analysis, risk free!

Nenhum comentário:

Postar um comentário