Recently NY Fed president William Dudley said 'We estimate that there are roughly 3 million vacant housing units more than usual', and other sources have mentioned there are close to 19 million vacant housing units in the U.S.!

What does it all mean?

The number to start with is the 'visible supply' reported monthly from the National Association of Realtors (NAR). At the end of October, the NAR reported there were 3.86 million homes for sale.

Click on graph for larger image in graph gallery.

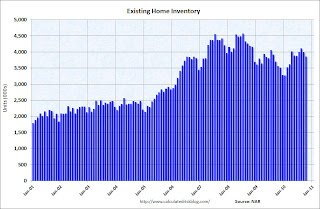

Click on graph for larger image in graph gallery.This graph shows nationwide inventory for existing homes.

Notice that inventory started to increase in the 2nd half of 2005. That was one of the indicators I used to call the top of the housing bubble.

Also notice the seasonal pattern for inventory - inventory increases in the spring, and usually peaks during the summer months, and then falls off sharply in December as homeowners take their homes off the market for the holidays. I expect NAR reported inventory to fall to around 3.5 million of so in December (down from 3.86 million in October, but up from 3.283 in December 2009).

This brings up an interesting point about how the NAR calculates 'months-of-supply'. The simple formula is months-of-supply = inventory divided by sales. The NAR uses the Seasonally Adjusted Annual Rate (SAAR) of sales, but the Not Seasonally Adjusted (NSA) inventory - even though there is a clear seasonal pattern for inventory.

The NAR formula is: months-of-supply = (inventory (NSA) /sales (SAAR)) * 12 months. (edit: oops, inverted initially, correct above) For October, the NAR reported 4.43 million sales (SAAR), and 3.86 million units of inventory, so that equals 10.5 months of supply.

If inventory drops to 3.5 million in December (normal seasonal decline), but the sales rate stay at 4.43 million, the months-of-supply metric will decline to 9.5 months. Some analysts might report that decline as 'good news' even though it is just because of the normal seasonal change in inventory.

A couple more points:

• Historically year end inventory is around 3% to 3.5% of the total number of owner occupied units. Currently there are about 75 million owner occupied units, so a normal level of year end inventory would be around 2.3 to 2.6 million units. So the visible inventory at around 3.5 million would be significantly above the normal level.

• It is the visible inventory that impacts prices. Also important is the level of distressed sales (short sales and foreclosures).

CoreLogic reports the number of distress sales in their monthly US Housing and Mortgage Trends.

CoreLogic reports the number of distress sales in their monthly US Housing and Mortgage Trends.This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006. From CoreLogic:

Distressed sales fell 10 percent in August to 68,700, the lowest level since May 2008. Although the level of distressed sales declined, it simply reflects the weak demand in the market overall because total sales also declined and the distressed sale share remained stable at 28 percent.So both the level of visible inventory and the percentage of distressed sales is elevated - and that puts downward pressure on house prices.

The next number is the 'pending sales' of 2.1 million units. This was reported by CoreLogic this week:

This graph from CoreLogic shows the breakdown of 'pending sales' by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the 'visible supply' and cannot be counted as a pending sale.

This graph from CoreLogic shows the breakdown of 'pending sales' by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the 'visible supply' and cannot be counted as a pending sale.CoreLogic estimates the 'pending sale' (by this method) at about 2.1 million units. This number is useful - especially the trend - because it suggests that the visible inventory will stay elevated for some time. And also that the number of distressed sales will stay elevated.

Some analyst have called the number of REOs and total delinquent loans as the 'shadow inventory'. This is incorrect for two reasons: 1) some homes are listed for sale and are visible (CoreLogic removed these homes from their pending sales metric), and 2) some loans will cure from the borrower catching up, the sale of the home, or with a loan modification.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.A fairly large number of 90+ day and in-foreclosure loans are curing too. This is probably because of modifications - and there will probably be a high percentage of redefaults - but this shows why you can't include all delinquent loans as part of the 'shadow inventory'.

And that brings us to the 7 million delinquent loans. There are two sources for the number of delinquent loans: the Mortgage Bankers Association (MBA) quarterly National Delinquency Survey, and a monthly report from Lender Processing Services (LPS).

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered 'about 44 million first-lien mortgages on one- to four-unit residential properties' and the 'NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market.' This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

And from LPS Applied Analytics October Mortgage Performance data:

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

And finally, what about those '3 million excess vacant housing units'?

This number comes from the Census Bureau's quarterly Housing Vacancies and Homeownership. This report shows almost 19 million total vacant housing units, but that number is pretty meaningless and includes 2nd homes, partially constructed new homes, and much more.

The 3 million number is calculated using the homeowner and rental vacancy rates, and estimating the number of excess units above the normal frictional level. There is always some number of vacant homeowner and rental units as people move and for other reasons. So the excess is the number above this frictional level. The NY Fed also added in a part of the increase in 'Vacant, held off market, other' to obtain the 3 million estimate.

I think this last portion of the 'excess vacant inventory' is less reliable, and I just use the homeowner and rental vacancy rates. My current estimate is about 1.55 million excess vacant units. This is a key number because once the excess is absorbed in an area as new households are formed, then new construction will begin - and that will mean a pickup in economic activity and employment.

The key numbers to follow for the housing market are 1) existing home inventory, 2) number of delinquent loans, and 3) the excess vacant inventory.

Nenhum comentário:

Postar um comentário