The Credit Crisis and the U.S. Dollar

First it was the Japanese financial crisis in 1991, and then came the Asian financial crisis in 1997 and the Russian crisis in 1998; now it’s Wall Street’s turn. The financial debacle in the US is no longer only a subprime mortgage issue; instead, the drying liquidity has spread the problem to many corners of the financial world including auction rate securities, bond insurers, and collateralized debt obligations.

On March 13, 2008 Standard & Poor’s reported that write-downs on subprime debt have likely hit the halfway mark and that the end was in sight. Yet, Bear Stearns (BSC) announced the following day that it had turned to J.P. Morgan Chase and the Federal Reserve for an emergency bailout sending the stock down by 47 percentage points. Exactly when the credit freeze will end is a question that no economist or financial analyst can answer at this point. A few analysts have reported the notion that this is the worst set of macroeconomic conditions since the Great Depression.

As a long-short trend trader, I invest where the market moves. It is important to realize that the market is not static; reversals can occur very quickly and an astute trader must be alert at all times and always be ready to get in or cash out. My trading style is based on a fundamental first, technical second philosophy. I fist analyze the fundamentals of the industry I’m interested in order to understand where the industry is headed, its performance versus the overall economy and a general understanding of its strengths and weaknesses. I then conduct technical analysis on companies within the sector to determine when to trade, based on my trading plan.

In this paper, I will discuss some of my trading ideas for the next few quarters in 2008, specifically taking a macroeconomic viewpoint. The discussion will aim to dissect the major trends with the economy, and a discussion of where I think some of the cyclical plays are within these sectors.

The markets for discussion include the US dollar, Precious Metals, Financial Services, Retail & Consumer Packaged Goods and Real Estate.

Weakness In The US Dollar

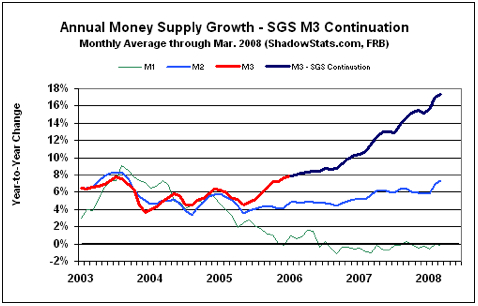

The US Dollar has been in a secular bear market for several years - it has depreciated by over 35% versus the Euro over the last five years. The government controlled media is finally beginning to raise voices over the economic problems that alternative media have been talking about for years. The United States is facing an inflationary depression, and this trend will likely not ease any time soon. Independent studies have shown that the M3 money supply – the entire money within an economy, has been seeing annual increases of around 16-17%. The Fed stopped publishing M3 numbers in March 2006, around the time when the numbers began skyrocketing.

The increase in money supply is one of the underlying reasons for the devalued currency. The US dollar index – a benchmark of the USD to a basket of foreign currencies, has decreased from the 80’s to the low 70’s over the past year.

Global Confidence In the USD Eroding

It is becoming increasingly clear that the world’s reserve currency is shifting from the USD to the Euro and commodities. The question on the minds of most investors is if the US dollar will continue to decline and if so for how long. Weakness in the US Dollar has been accelerated due to poor economic data. According to recent data released by the Federal Reserve and the US government, home owner equity is at its lowest levels since 1945, consumer debt has grown to $2.52 trillion and unemployment levels are at its highest levels since 2003. Furthermore, it is rather disturbing to know generally that statistics published by the Federal Reserve and the US government understates economic problems; so the recent economic data may indeed be worse than what was published by these two parties.

This economic data has created much fear in the economy, which has sent many investors seeking safe havens in other currencies and commodities such as the Euro, oil and gold. The Consumer Sentiment Index from Michigan University and a leading indicator of economic recessions has been declining since early 2007. As consumer and investor confidence in the United States continue to weaken, more investment will pour out of the country, causing the dollar to slide even more.

In addition, as the value of the real estate asset base that was used as collateral to support the massive issuance of credit over the past few years becomes further destroyed, the lack of credit will continue to cause the Federal Reserve to cut interest rates and print more money which will send the economy into a hyper-inflationary state. It is scary to think that it was only 15 years ago, that Japan underwent a very similar real estate bubble, financial crisis and economic recession that the United States is going through now.

However, what seems to be forming in the US economy is a vicious cycle, forcing the value of the US Dollar to decline:

1. US dollar declines

2. Investor confidence drops

3. Housing declines further

4. Investments are pulled out of the country

5. Banks go insolvent

6. Widespread job losses

7. Decreased consumer spending

8. Fed cuts interest rates

9. Monetary easing as the central reserve prints more money

10. Increase in inflation

11. Us dollar declines

As the economy continues to weaken, interest rates continue to decline, inflation continue to skyrocket and the money supply continue to increase, it seems inevitable that this perfect storm will continue to drive down the value of the US Dollar. What this means for investors is in the coming months, there will be plenty of opportunities to short the US dollar, long foreign currencies and long commodities such as oil and gold.

Nenhum comentário:

Postar um comentário