http://seekingalpha.com/article/105316-this-market-is-one-of-opportunity?source=email

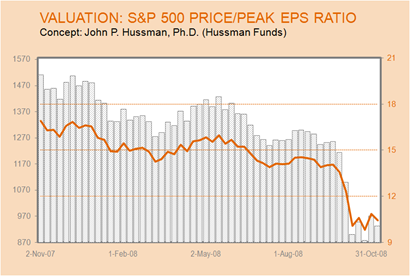

For long-term investors, there is little doubt that the market is oversold in the near term. Our standard valuation metric, the price-to-peak earnings multiple, is down to 10.4x this week. We think this is further evidence that, although we are not necessarily at a bottom, the stock market is poised to provide better than average long-term returns. For a very clear and thorough explanation of why using normalized peak earnings is so vital to understanding market valuation, allow me to refer you to John P Hussman’s (Ph.D.) weekly comment (How Low? How Bad? How Long?). Hussman is one of the best writers in finance today and this insight, in particular, caught our attention:

It is important to note that even in the Great Depression, it took until 1931 for the price/peak-earnings multiple on the S&P 500 to drop below 11. That did not occur after the 1929 plunge. Moreover, the peak earnings level in 1929 reflected a spike that (aside from a brief period in 1917) was unusually high in the context of normal earnings. I can’t possibly overemphasize how important it is to gauge valuations on normalized earnings, not spike peaks or spike troughs. On normalized earnings, stocks were still overvalued at the 1929 trough. It took until 1931 for stocks to look cheap even on the basis of peak earnings from 1929.

So historically speaking, this market is one of opportunity; for the last five weeks the S&P 500 has traded below 11 times peak earnings. Valuation has not been the driver of this market downturn, as fear of recession has dominated investor psychology - but valuation will not be ignored indefinitely. Instead of claiming to be able to time the market, which has always been a fool’s game, we would recommend looking at further market weakness with an opportunistic eye.

[click images to enlarge]

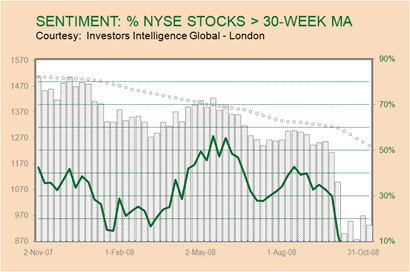

A clear consensus has been reached regarding investor sentiment. For the fifth straight week the percentage of NYSE stocks selling above their 30 week moving average is below 10% (this week it's 4.8%). As we have mentioned in previous newsletters, since we began publishing the EIG nearly 20 years ago, never have we seen such clear evidence of a bearish slant on the market. Admittedly, this is a relatively short time frame, but compared to the recession of the early 2000s, this instance is extreme. After the dotcom bubble burst and the NASDAQ lost nearly 80% of its “value”, there were never even two weeks below the 20% level in this investor sentiment indicator. To be a good value investor is to be a contrarian and it is tough to find a more clearly laid out consensus in overall sentiment than we see right now.

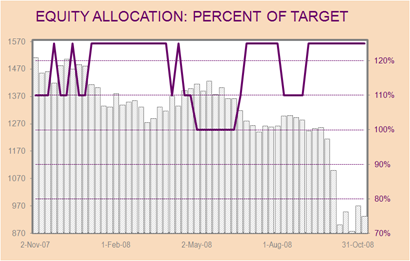

Our asset allocation model advocates greater than normal exposure to equities right now. Of course, this is not a proclamation to buy stocks blindly with little regard to macroeconomic conditions; however, we believe that U.S. equities will be among the first securities to rebound when the dust settles. In our view, earnings thus far have not been worse than we expected; it has been the lowering of future guidance that has dragged down many stocks. While it is probably prudent for a company to lower its guidance in the face of uncertainty, that lowered guidance does not necessarily mean that earnings will in fact drop in line with guidance. Governments around the globe, as we have seen with China over the weekend with their stimulus plan, are recognizing the crisis facing the global economy and are being proactive in combating it with stimulus packages and looser monetary policy. In a globalized economy, with all major central banks acting in unison to combat economic malaise, we should begin to see results from these efforts in the coming quarters.

Nenhum comentário:

Postar um comentário