http://seekingalpha.com/article/104394-when-will-the-recession-end?source=headline1

Now that the election is over, President-elect Obama has a tough economic road ahead. The advanced GDP report of -0.3% suggests that the

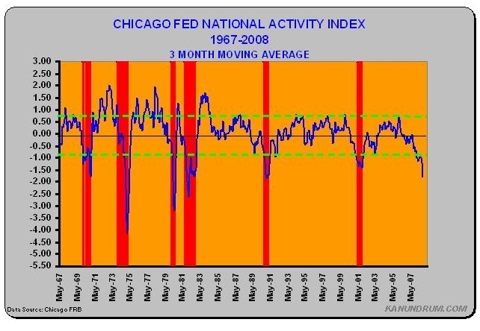

A widely used index of economic activity is the Chicago Fed National Activity Index [CFNAI]. The index is released monthly and is a weighted average of 85 indicators of economic activity. Since the index is calculated using monthly data it can be used as a leading indicator for quarterly GDP. The following chart shows the CFNAI since 1967 with recessions in red.

The Chicago Fed produces two indexes, a monthly index and a three-month moving average of the monthly index. The three-month moving average index smoothes any volatility in monthly numbers and is used for economic forecasting.

A zero value for the three-month CFNAI indicates that the economy is expanding at rate of growth that is consistent with its historical trend. An index reading below -0.70 following a period of expansion indicates that a recession may have started. A reading above 0.70 two years into an economic expansion indicates increased probability that a sustained inflationary period has begun.

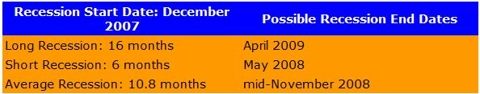

The three-month CFNAI crossed below -0.70 in December of 2007 and is therefore the likely start date of the current recession. According to the NBER, since 1967 there have been 6 recessions. The longest recessions lasted 16 months and occurred from November 1973 to March 1975 and July 1981 to November 1982. The shortest recession started in January 1980 and ended in July 1980, for a total of 6 months. The average recession lasted for 10.8 months.

Using the NBER figures and a start date of December 2007, the following recession window can be interpolated:

From this table it is clear that the

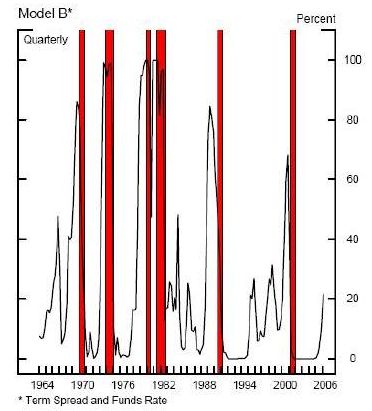

The start date of the recession is consistent with Federal Reserve models of the probability of recession. In a 2006 report, Jonathan Wright, a Fed researcher, developed a model for predicting the probability of a recession using the Treasury yield curve. The model developed used the 10 year - three-month spread and the effective fed funds rate. The following chart is from Wright's paper and shows the probability of a recession since 1964 using his Model B. (Recessions in red)

Model B was found to be a good predictor of recessions within 12 months of a high probability reading. Interestingly, it appears that the critical probability level for predicting a recession is 50%. Once the indicator reaches this level, there is high certainty that a recession will occur in the next 12 months.

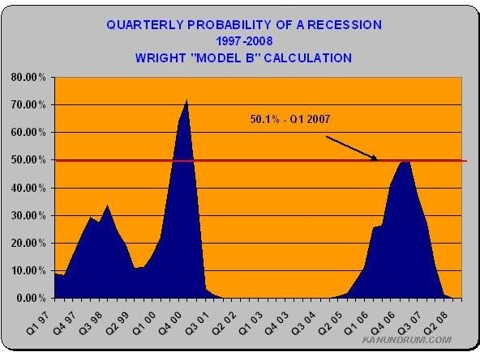

Using Model B and current data yields, the following results from 1997-2008.

This graph illustrates that the probability of a recession in the next 12 months reached the critical level of 50% in the first quarter of 2007. Within 12 months, the three-month CFNAI crossed below -0.70 indicating a recession has begun. This provides more support for December 2007 as the start date for the current recession.

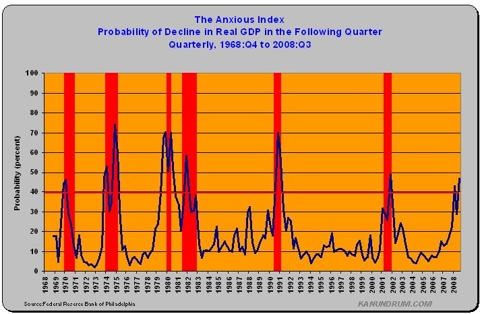

The Federal Reserve Bank of Philadelphia also publishes the probabilities of a recession in its Survey of Professional Forecasters [SPF] report. This data goes back to 1968 and shows the probability of a recession occurring in the next quarter. (Recession in red)

With this series, it appears that 40% probability is the critical level in predicting a decline in GDP in the next quarter. Interestingly, the probabilities breached the 40% level in the first quarter of 2008. While not an exact match with Wright's Model B or the CFNAI data it is fairly close and can serve as additional evidence that the current recession began near the end of 2007 and the beginning of 2008.

After falling below 40% for one quarter, the Anxious Index breached the 40% probability mark again in the third quarter of 2008. This suggests that forecasters are expecting a decline in GDP for at least one more quarter. This projection means that the recession will last until March 2009, which is consistent with the long recession projection of April 2009.

The next CFNAI report will be released on November 24, and could provide clues regarding the duration of the economic malaise. Watching the 10 year - three-month spread and effective rates will also be of utmost importance.

Nenhum comentário:

Postar um comentário