http://seekingalpha.com/article/103408-where-have-all-the-peak-oil-believers-gone?source=feed

Crude oil is down more than 50% from its high of $147 a barrel. Where are the peak oil believers? the breathless analysts and cheerleaders of the commodity that warned of a Mad Max armageddon?

Physical peak oil, which I have no reason to accept as a valid statement either on theoretical, scientific or ideological grounds, would be insensitive to prices. …In fact the whole hypothesis of peak oil – which is that there is a certain amount of oil in the ground, consumed at a certain rate, and then it’s finished – does not react to anything…. (Climate change) is likely to be more of a natural limit than all these peak oil theories combined. … Peak oil has been predicted for 150 years. It has never happened, and it will stay this way.

Dr. Rühl, chief economist of BP

Last Friday, for the first time in two years, OPEC supposedly cut their production by 1.5 million barrels a day. I say supposedly because these agreements don’t mean much when the member countries are facing the same financial crisis. OPEC members are notorious for cheating on their quotes. So it is difficult to give them the benefit of the doubt today when they are in desperate need of cash from the only thing propping up their economy.

Last Friday, for the first time in two years, OPEC supposedly cut their production by 1.5 million barrels a day. I say supposedly because these agreements don’t mean much when the member countries are facing the same financial crisis. OPEC members are notorious for cheating on their quotes. So it is difficult to give them the benefit of the doubt today when they are in desperate need of cash from the only thing propping up their economy.

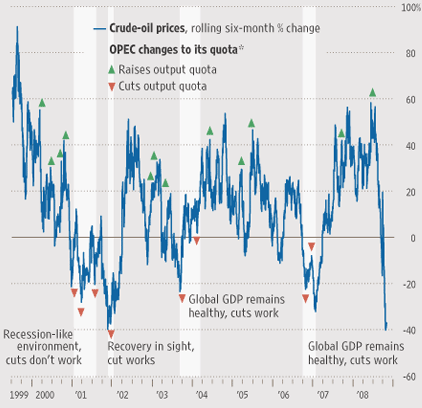

Here is an interesting chart showing the history of OPEC changes in supply. In recessions, when there is less demand for oil, price cuts or better put, announced price cuts, don’t have the same effect.

A walk down contrarian lane brings us to the The Economist cover from March 6, 1999 (see above). At the time oil was trading around $14 and thought by many to only be able to go lower. What we saw recently, sentiment-wise, was the opposite of this, where “peak oil” came to be bandied about incessantly in the media and taken as gospel to imply that oil could only go up.

Oily Bubble

Crude oil’s bubble-like march higher was rationalized by two main proponents, Goldman Sach’s Arjun Murti and Mathew Simmons. Simmons argued for 150 year old peak oil rationale for a spike while Murti made headlines in May 2006 by predicting a “super spike” taking us to $200 a barrel oil.

Murti has since cut his targets repeatedly as oil has crashed through them. First $140, then $110, then $75 and most recently in a bold attempt to get ahead of the price, $50 a barrel.

Although Murti may not have intended his analysis to get so much publicity, it did, and a lot of people came to believe that oil was somehow destined to continue higher: thus proving once again that listening to “experts” can be dangerous to your financial health.

The charts, however, were telling another tale to anyone who cared to listen to their whisperings. Crude oil had all the characteristics of a bubble and it has imploded like one too. Looking at a long-term chart, you can see that it has easily sliced through the long-term uptrend line.

If we are going to go through a deflationary period, then OPEC countries are in for a world of hurt because the demand curve has shifted. If they lower production, they hurt themselves; if they don’t and keep it steady or cheat by increasing it, they will flood the market with supply.

From a technical point of view, there is strong long-term support for crude oil in the $40 area. I have no idea if we will indeed go that low. But if we do, I’d suspect oil to find strong footing in that area.

Here’s a historical chart showing the previous OPEC changes in production:

Source: Wall Street Journal

Nenhum comentário:

Postar um comentário